Last week, the European Union introduced its 11th package of sanctions against Russia. The latest restrictions once again targeted oil supplies. From the very beginning of Moscow’s full-scale invasion of Ukraine, European countries have sought to strip Russia of its oil and gas revenues to hamper the war financing efforts. In reality, however, Western companies continue to supply dual-use goods and advanced technologies to Russia, including oil extraction equipment along with machines to refine and liquify natural gas. Novaya-Europe takes a closer look at the largest supplies we’ve managed to uncover.

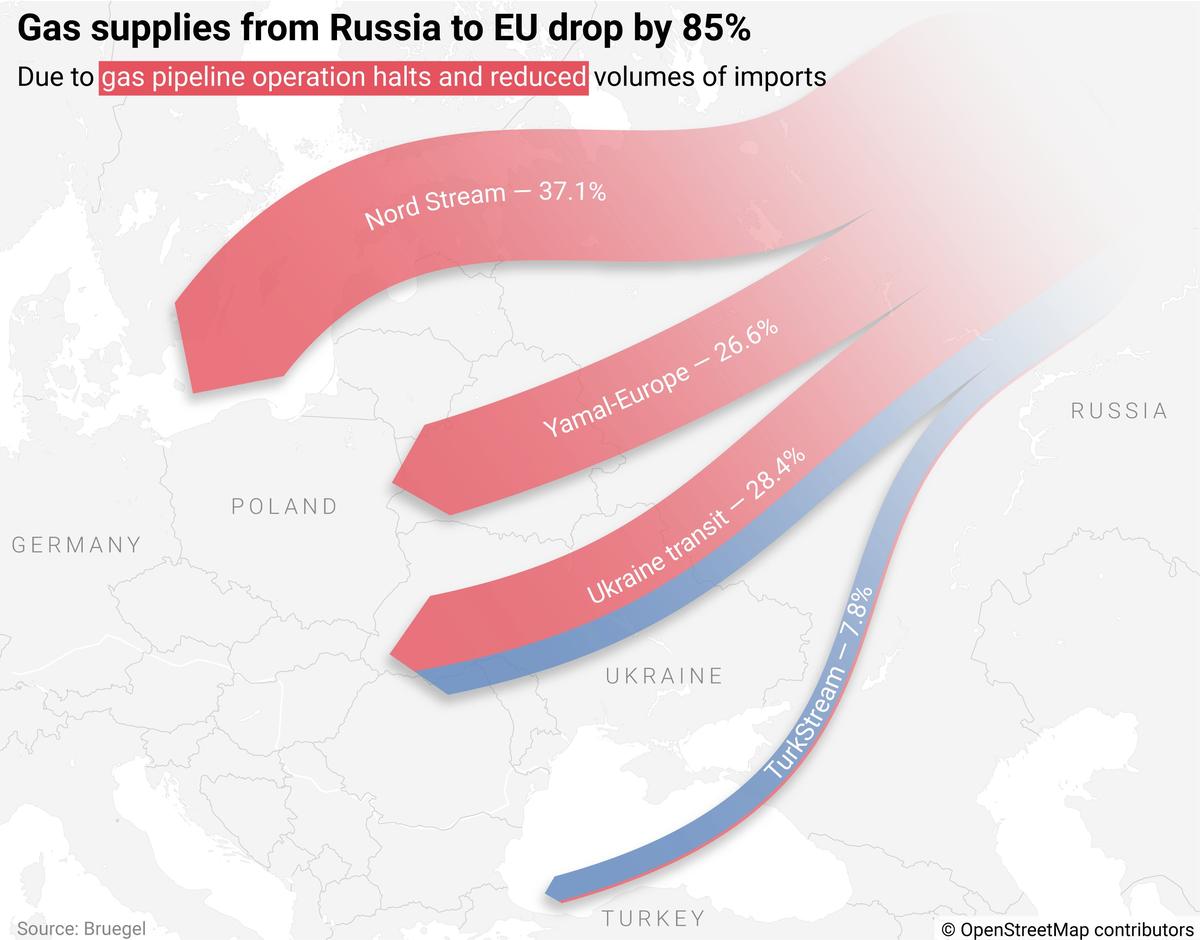

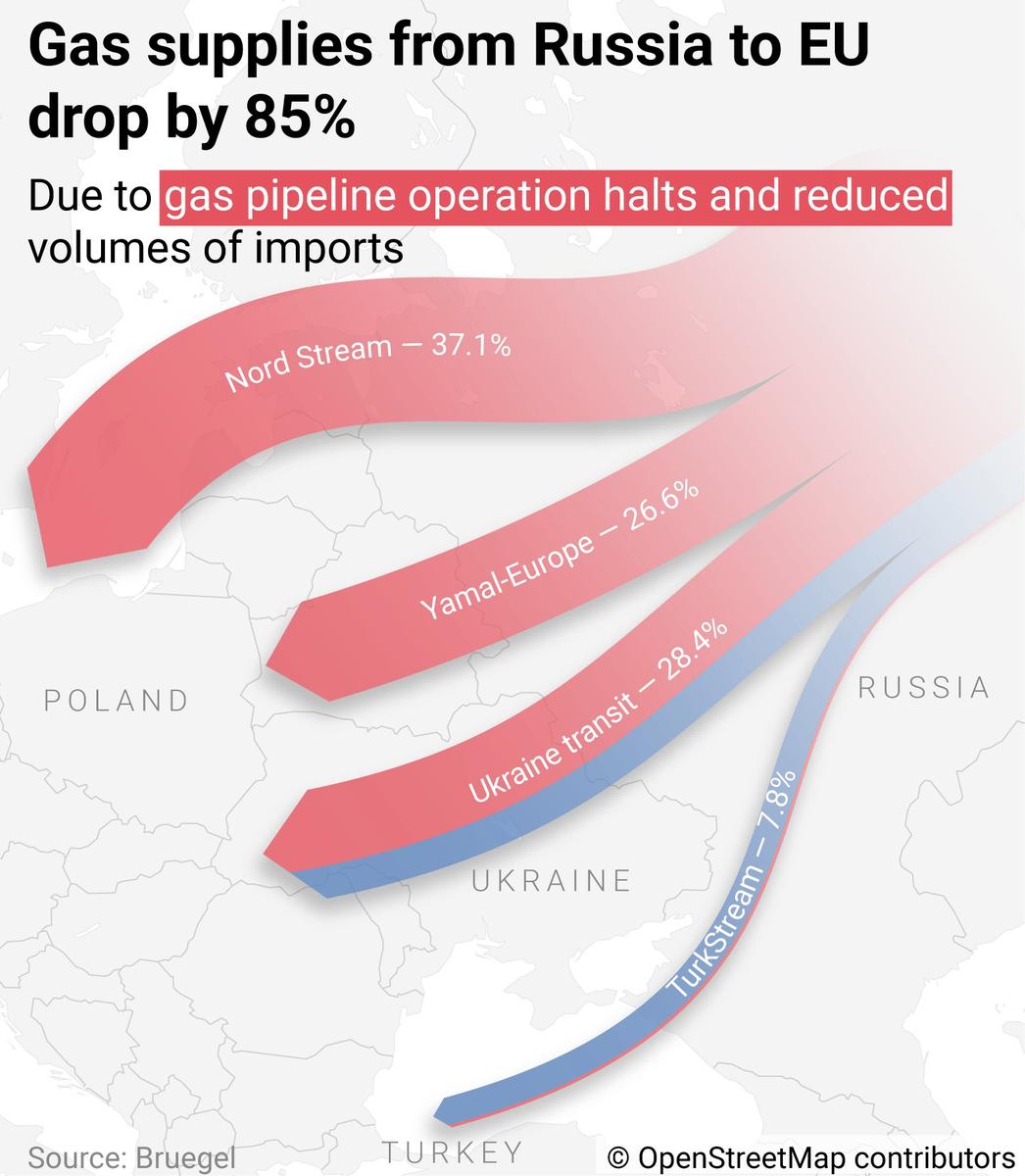

Last September, Russia essentially backed itself into a corner. The Kremlin shut down Nord Stream 1, a pipeline used to carry natural gas from St. Petersburg to Germany. Back in the beginning of 2022, Nord Stream 1 accounted for more than half of all Russia-EU gas supplies, an increase compared to the 2021 number of 40%, Bruegel data shows. Moreover, the Yamal-Europe pipeline operation came to a standstill, while the Ukraine transit went down as well. (It may even come to a grinding halt in 2024).

In 2023, the gas pipeline supplies from Russia to Europe plummeted by 85% compared to the same period in 2021, in the pre-war times. As a result, Russia’s Gazprom energy giant was forced to reduce gas production by almost 25%. Meanwhile, Russia’s gas-related revenues almost halved, dropping as low as 710 billion rubles (€7.3 billion) in January-May 2023.

Seemingly, the gas industry crisis and Russia’s dropping incomes are exactly what Brussels was after.

Paradoxically, the EU is not just imposing sanctions but also helping Russia to develop alternative ways to export its energy resources.

Firstly, Europe is ramping up purchases of Russian liquified natural gas (LNG). These orders increased in volume by almost 30% in the first five months of 2023 compared to the same period in 2021.

Brussels is investing billions of euros to construct new infrastructure necessary to import LNG to wean itself off Russian gas. Simultaneously, it is just switching to LNG supplies from Moscow, Albinas Zananavičius, Lithuania’s Deputy Energy Minister, was baffled in a comment for Reuters.

Secondly, the EU delivers LNG development technologies to Russia despite the fact that this was banned in accordance with the fifth package of sanctions adopted in April 2022.

As Novaya-Europe discovered in the ImportGenius database, the European Union supplied equipment to Russia worth almost $420 million between 24 February and the end of November 2022 meant for the construction of Arctic LNG 2, a new project located in the Gydan Peninsula near Yamal.

Once operational, it will be one of the largest in Russia. Meanwhile, 80% of its gas produce is earmarked for Asia rather than Europe.

A large stake (60%) of Arctic LNG 2 belongs to Novatek, the largest privately-owned gas producing company in Russia. Its shareholders include Leonid Mikhelson, Vladimir Putin’s friend Gennady Timchenko (blacklisted by the EU), France’s Total and Gazprom. Per Novaya-Europe’s earlier report, Total became the top earning business in Russia among the foreign companies that refused to quit the country in response to its aggression against Ukraine.

Despite the war and sanctions, Novatek already secured the main equipment for all three production lines of Arctic LNG 2, founder Leonid Mikhelson revealed in October 2022. Customs declarations show that the two biggest suppliers were American Baker Hughes and its Italian subsidiary Nuovo Pignone.

In March-August, Russia received Baker Hughes equipment worth almost $87 million, even though the company previously said that it would terminate exports to the country and maintenance of Russian LNG projects. Moreover, Germany’s Linde and SVT as well as Italy’s Ansaldo Energia and Officine Ram Power exported machinery worth tens of millions of dollars.

At the same time, 84% of the supplies received by Arctic LNG 2 were meant to be subject to export control, meaning that these technologies should have only been sold under specially-issued licences. Some of the customs codes specified in the documentation provided on the Russian border are directly listed in the Council of the EU’s regulations on sanctions. Some of them fall under the category of dual-use goods and advanced technology. The EU regularly updates and publishes these lists.

On 8 April 2022, the EU banned supplies of “goods which could contribute in particular to the enhancement of Russia’s industrial capacities”, particularly machines to produce LNG.

However, the legislation specified that if the deal was signed before 9 April 2022, the corresponding equipment could be exported by 10 July 2022, Mark Bromley, Senior Researcher with the SIPRI Dual-Use and Arms Trade Control Programme, explains. Indeed, 85% of the total amount of supplies for Arctic LNG 2 was finalised before 10 July.

Nevertheless, the equipment marked with “sanctioned” customs codes (8419600000, for instance) was flowing to Russia until November.

“There is always scope for circumvention with any set of sanctions and trade restrictions,” Bromley notes. “Even today, there are exemptions which allow for the licensing and export items on the EU dual-use list and items on the Annex VII list to Russia. The licensing authorities of individual [EU] member states have the final say in determining whether a particular product is covered by the control lists attached to the Russia sanctions and sanctions and export controls more broadly.”

Power of Gazprom

Arctic LNG 2 is not the only Russian project that continued to purchase equipment directly from Europe even after the full-blown invasion of Ukraine began. Gazprom and its subsidiaries use similar schemes to obtain what they need from the EU. We have tracked down supplies worth at least $48 million, which is far from being the complete picture. Some customs declarations simply omit countries of departure.

A plant that is being constructed in the Amur region, Russia’s Far East, will help Gazprom to process the gas flowing through the Power of Siberia pipeline to sell helium, ethane, propane, and butane to China.

The plant is set to become the second-largest in the world, while the process of its construction “is unparalleled in the history of Russia’s gas industry”, the company boasts on its website.

At the same time, Gazprom continues to buy the equipment for this large-scale state-funded project from Europe. Linde provides ethane extraction plants, Mek Piping sends mixing stations, while Siemens supplies heat exchangers — the equipment imported between the end of February and November totalled at least $15 million. The plant is expected to be fully operational in 2025.

Another example: REP Holding (part of the Gazprom Energoholding group of companies) bought Italian equipment worth $18 million and mainly used Lithuanian logistical companies to haul it to Russia. In particular, the company purchased components for the МS5002E gas turbine that are not produced in Russia. These turbines are used to pump gas via TurkStream.

Sanctions aren’t an obstacle for drilling

A similar situation is observed in the oil industry. Oil production-related sanctions were imposed back in 2014 when the EU and the US restricted supplies of equipment for deep-water, Arctic, and shale oil production projects. In the summer of 2022, the Ukraine war propelled lawmakers to expand the sanction lists. All equipment for oil extraction, exploration, and refining was banned.

Nevertheless, Europe-made machinery continued to flow into Russia, including direct supplies from Europe. European companies played a leading role in this scheme.

We tallied supplies worth almost $73 million via the ImportGenius database. This oil extraction equipment — Arctic-style hydraulic fracturing rigs, drilling rigs for oil and gas field development and exploration, parts of equipment and consumables, and others — was wheeled in from Europe to Russia between 24 February and late November 2022.

Germany’s KCA Deutag and its subsidiary Bentec supplied the biggest share worth $24 million directly from Europe. The latter produces drilling rigs, which particularly operate in the Arctic, in Russia’s Tyumen.

Aris Oilfield Tools exported another $17.8 million worth of equipment to Russia. Germany’s KATT GmbH also owned it until December 2022.

Finally, Garant Servis, a joint venture of Gazprom Neft and Sberbank, ranks third in the total volume of purchases. Both corporations are sanctioned by the EU, which did not prevent them from buying a drilling rig from Italy for $15 million.

After the Kremlin unleashed its war on Ukraine’s largest American and European oil service companies announced their withdrawal from Russia. One of them, Halliburton, transferred its assets to the BurServis legal entity, which is controlled by the Russian management. BurServis now continues to import original equipment produced by Halliburton and other American and Canadian companies, just not directly but via Singapore.

American Schlumberger does a similar thing. It never quit Russia but suspended all investments. Essentially, the company is still getting the equipment via the UAE, Singapore and China.

Indicative supplies

The majority of oil producing goods imported by Russia from the EU (67%) falls under the dual-use and advanced technology category. In 2022, these supplies dropped approximately to the level of 2007, which is far from zero. Compared to 2021, they lost about 40% in the money value, contracting from €30 billion to €18 billion. And this is only according to the official EU statistics.

The drops in supplies came in waves. The first bans on dual-use goods were imposed on the very next day after Russia invaded Ukraine. This list was later expanded in April, June, July, and October. Still, the sales of sensitive items stayed at about half of the pre-war level through most of 2022. Russia officially purchased goods worth around €1.3 billion every month.

In December, the dual-use goods list was expanded, pushing the supplies to drop by 60% compared to the pre-war times. Then Russia was finally banned from importing nerve agents, night-vision and radio-navigation equipment, electronics and IT components for the military industry, and riot-control equipment.

At the same time, exports of some items on the advanced technology list even managed to increase in 2022. This was mainly medicines as well as laboratory and medical equipment. But that’s not it. For example, sales of industrial equipment increased: furnaces, heat exchangers, drilling and mining equipment, containers for LNG, as well as signal rockets, smartphones and parts for them.

“The regulations provide for a number of exceptions to the ban on dual-use equipment supplies: goods and technologies for humanitarian and medical purposes, for media use, software updates, consumer communication devices, and also goods for personal use by people travelling to Russia and their family members,” a sanction lawyer tells Novaya-Europe on the condition of anonymity.

Moreover, dual-use goods exports can be approved if the deal was signed before 26 February 2022, while the permission itself was requested before 1 May 2022.

The European Commission never replied to our request for a comment.

This article was written in cooperation with Germany’s Süddeutsche Zeitung.

Join us in rebuilding Novaya Gazeta Europe

The Russian government has banned independent media. We were forced to leave our country in order to keep doing our job, telling our readers about what is going on Russia, Ukraine and Europe.

We will continue fighting against warfare and dictatorship. We believe that freedom of speech is the most efficient antidote against tyranny. Support us financially to help us fight for peace and freedom.

By clicking the Support button, you agree to the processing of your personal data.

To cancel a regular donation, please write to [email protected]